november child tax credit schedule

November 15 and December 15 are the last two days for monthly. For details see instructions for.

If you qualify for the advance Child Tax Credit you can expect your next payment to hit your bank.

. When you file your 2021 tax return youll be able to claim any child tax credit money you havent yet received -- at least half or more if you opted out of advance payments or. Simple or complex always free. You can qualify for the full 2000 child tax credit if your modified adjusted gross income MAGI is below 200000 for single filers.

Schedule of 2021 Monthly Child Tax Credit Payments. When Child Tax Credit Payment for November 2021 Will Get to You Dawn Allcot 11112021. The excelsior investment tax credit component.

Ad See If You Qualify To File For Free With TurboTax Free Edition. General business corporations may claim an investment tax credit ITC under section 210-B1 against the tax imposed by Article 9-A for the tax year. For joint filers its 400000.

3600 per child under 6 years old. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. The IRS will send out the next round of child tax credit payments on October 15.

Ad child tax credit schedule. The excelsior research and development tax credit component. Goods and services tax harmonized sales tax GSTHST credit.

November 25 2022 Havent received your payment. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. November 11 2021 142 PM 2 min read.

With the November payments still on their way to some families this is an updated list of the 2021 Child Tax Credit advance payments schedule. The Child Tax Credit was to be expanded for five years until 2025 but now the end of 2022 will be the deadline. And the excelsior child.

When the First COLA Checks Will. The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day. November 15 SHOULD BE PAID.

Easily Download Print Forms From. The Internal Revenue Service. Goods and services tax harmonized sales.

November 18 2022. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming. The excelsior real property tax credit component. This measure was to coax the vote of Senator Joe Manchin a.

Child tax credit schedule. Wait 5 working days from the payment date to contact us. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. File a federal return to claim your child tax credit. Simple or complex always free.

File a federal return to claim your child tax credit. Have been a US. Blank Forms PDF Forms Printable Forms Fillable Forms.

December 13 2022 Havent received your payment.

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Here S Who Qualifies For The New 3 000 Child Tax Credit

Federal Reserve Banks Share Information About Advance Child Tax Credit Payments

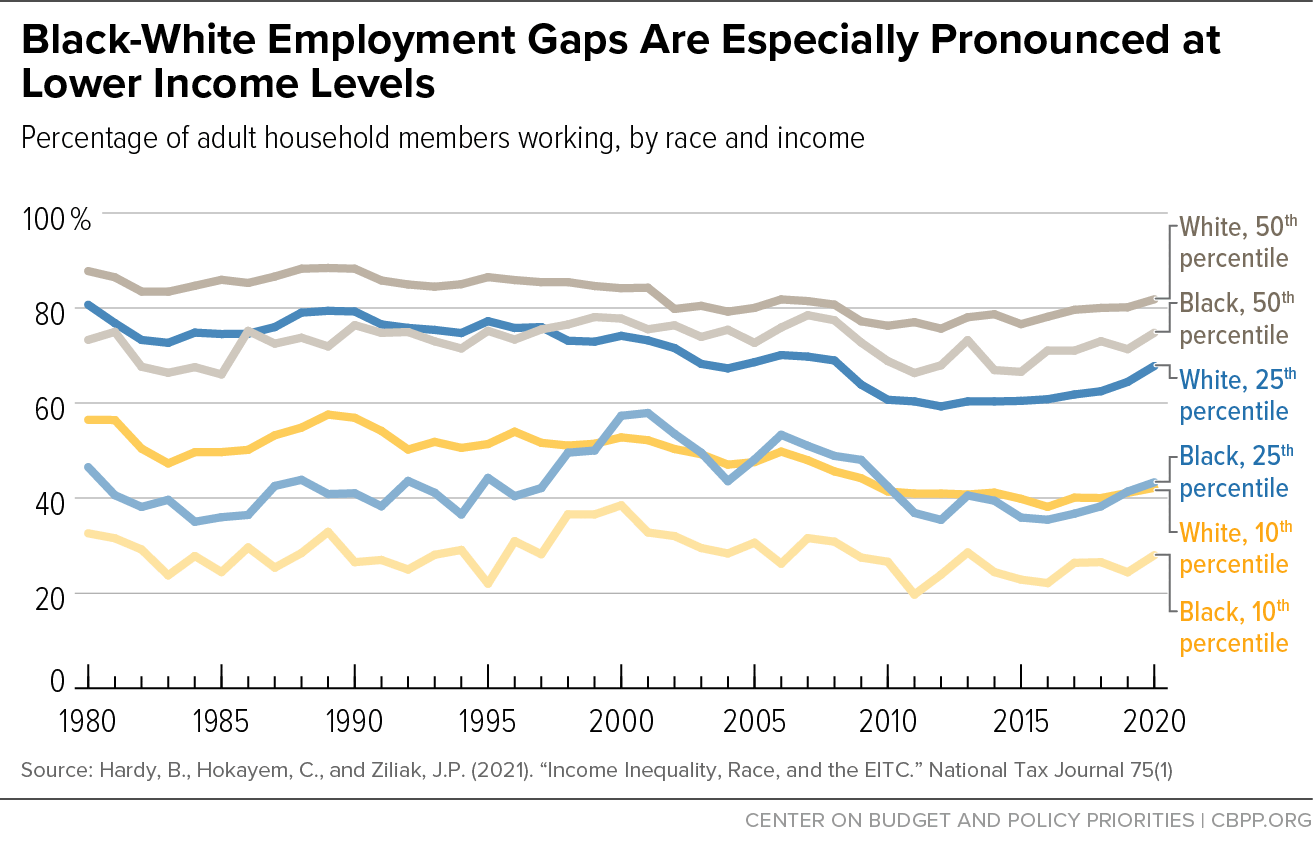

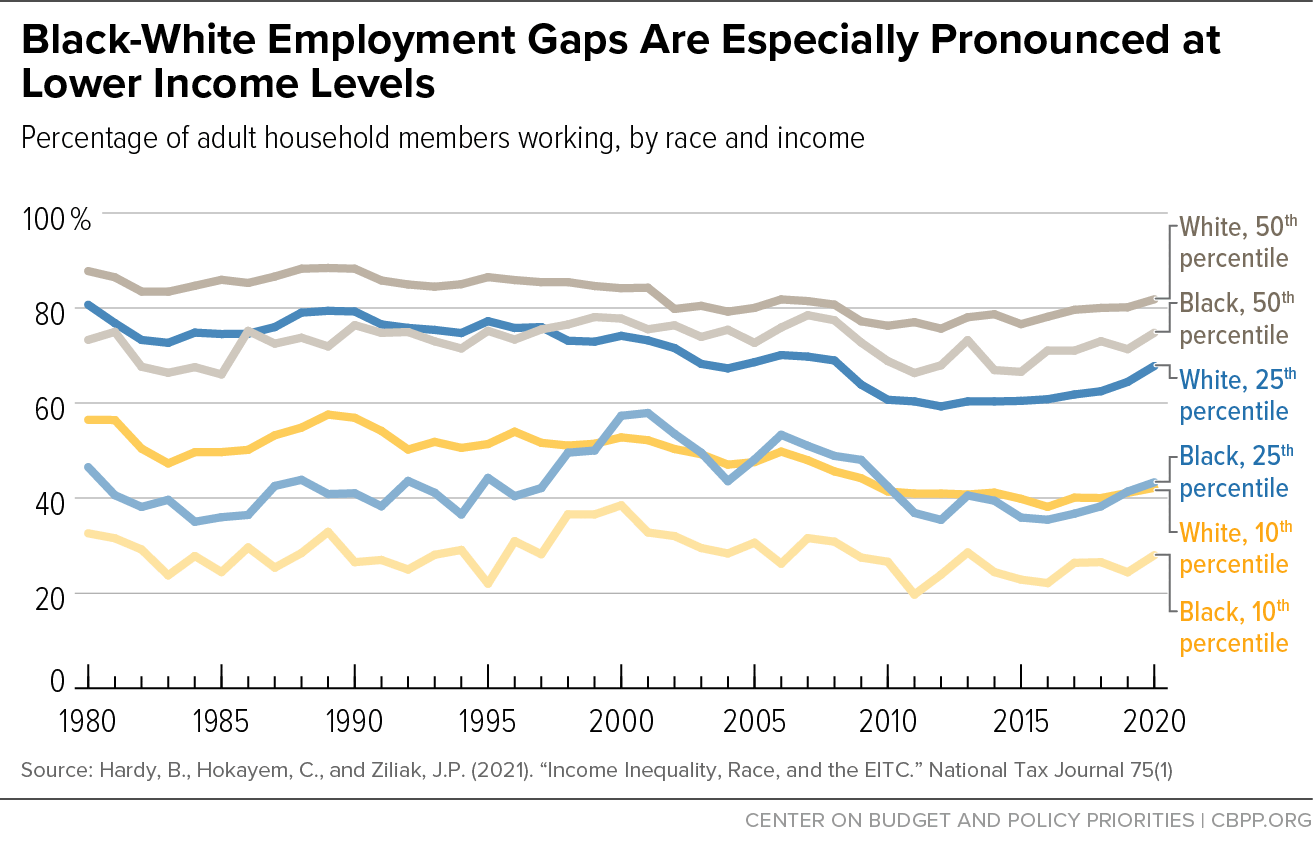

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Childctc The Child Tax Credit The White House

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Child Tax Credit Has A Critical Role In Helping Families Maintain Economic Stability Center On Budget And Policy Priorities

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

House Passed 1 7 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger